If you reside inside Texas or perhaps the The southern area of, you’ve more than likely observed Countries Mortgage. In reality, you can already getting a banking consumer having father or mother organization Regions Financial.

The business try a banking leader in the states away from loans Saugatuck Alabama and you will Tennessee, so if you’re the type you to definitely wants to do-all the providers under one roof, Nations Mortgage might be for your requirements.

Apart from the solid exposure in the The southern part of, nonetheless they provide financial and home loan features in the Indiana, Illinois, and Missouri.

Their first mountain is that you need to have their financial of a lender you can rely on, particularly a large mil-buck financial with a near 50-season background.

Countries Mortgage Short Facts

- In public areas traded industrial financial offering people in the Midwest, South, and you may Tx

- Founded in 1971, headquartered from inside the Birmingham, Alabama

- One of the primary finance companies in the usa (best 40)

- A high-fifty mortgage lender nationwide by volume

- Funded almost $eight billion for the homes fund thru retail channel during the 2019

- Florida taken into account twenty-five% regarding full home loan regularity

- And a major lending company in the states from Alabama and Tennessee

The organization, that’s one of the greatest financial institutions in the us, is actually created in 1971 which is based into the Birmingham, Alabama.

A year ago, it funded nearly $seven mil home based fund, permitting them to simply slip to your greatest-50 mortgage lender number across the nation.

Additionally, it exited the correspondent financial credit providers into the 2018. So it’s clear they’ve been entirely focused on originating mortgage brokers through the brand new retail, direct-to-user channel.

Surprisingly, Regions in addition to sells homes and you will look for Countries-had features on their site. That it would be a one-avoid look for some home buyers!

Getting a mortgage that have Countries Financial

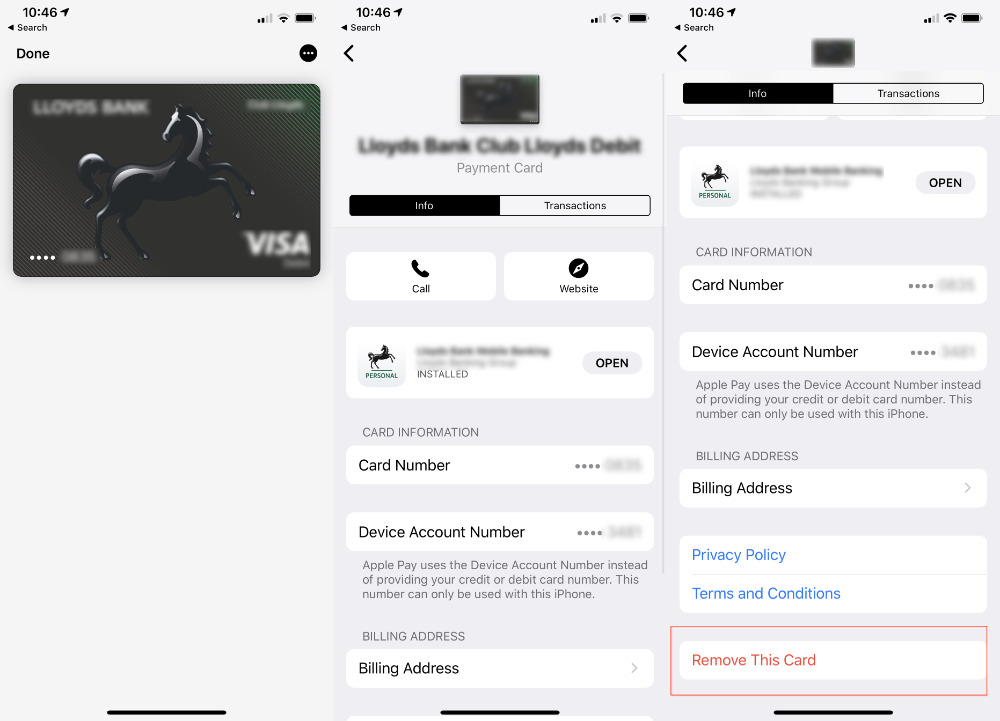

- You could potentially sign up for a home loan right from their website otherwise on your cellular phone

- People say it takes regarding 7 times to do the application form

You can begin a number of different ways. Naturally, you can direct right down to a brick-and-mortar branch if that is your look, or maybe just refer to them as up on the device.

You can also visit their site and appear for a financial loan administrator near you. You may inquire about property purchase or home loan re-finance that with their online function.

And when you are going the web based route and pick a certain loan administrator, you could potentially apply for home financing close to their site as opposed to any individual communications.

Like other electronic home loan programs, you will need to sign up, bring earliest email address, after that offer most economic pointers such as your income, lender facts, work records, and stuff like that.

Once your mortgage was submitted, you could potentially would they through the borrower portal anytime. You will be provided an inside-manage number additionally the substitute for receive status standing to remain on the learn.

In general, it seems like a smooth and simple-to-explore home loan dash which should allow rather painless to get the loan on the finishing line.

If you are looking to have home financing pre-qualification, the Countries Pick Fuel product will provide a broad thought of how much cash it’s also possible to qualify so you’re able to obtain.

What kinds of Mortgage brokers Do Places Home loan Render?

Countries Home loan offers a variety of style of mortgage loans, including home pick money, financial refinances, repair loans, and structure-to-perm fund.

You can access this new collateral of your house thru an earnings aside re-finance or a property equity line of credit (HELOC).

And you may very first-day home buyers can take advantage of reasonable-advance payment programs, including the step three% off required by Fannie/Freddie, or the step 3.5% down required by brand new FHA.

Nevertheless they promote USDA home loans for those to shop for when you look at the rural elements of The usa, and you will Virtual assistant funds for effective obligations and veteran homebuyers otherwise present residents.

You can aquire a predetermined-rates home loan instance a 30-12 months fixed or fifteen-year fixed, otherwise a changeable-speed mortgage instance a 5/step 1 otherwise 7/step one Arm.

Those purchasing a particularly high priced home or refinancing more substantial current loan will enjoy its jumbo financing products.

Eventually, since they’re good depository bank, they are capable promote blogs the other men cannot because they could well keep they within their loan profile than it is to help you promoting it.

Nations Home loan Cost

But in lieu of others, it take care to define as to the reasons, claiming it’s because of the ongoing fluctuation from financial rates.

We usually concur that reported mortgage rates commonly really worth a great deal, but it is however nice to see one thing.

To put it differently, you’ll not understand how aggressive he is if you don’t get in touch and get a free of charge price price.

It means we do not learn their attention costs or costs, and so they don’t appear to give one offers so you can current Places Lender deposit customers such as different higher banking companies create.

To summarize, make sure you look around to ensure they give good blend of rate and you may closing costs prior to other banking companies and mortgage brokers.

Nations Financial Product reviews

Its moms and dad organization, Nations Monetary Corp., is certified with the Bbb, and also become due to the fact 1956. Unclear why more than when they was centered.

They already delight in an one+ Better business bureau score, that is according to grievances history and how a pals responds in order to told you grievances.

There are quite a few complaints against the providers, however, they’re also a huge lender rather than them have to do with their property credit office.

Places Lender features a great 4.3-star rating away 5 into the Trustpilot predicated on around 100 consumer critiques, and this once more commonly limited to their residence financing company.

There is also a great step 3.9-celebrity get off 5 on the WalletHub centered on almost dos,000 reviews. Again, you will have to brush using them to get a hold of which actually pertain to help you mortgage loans.

Your very best disperse could well be to seem upwards personal financing officer’s critiques who do work within Countries Financial into Zillow to see exactly how a particular private have fared before.