Getting economically match, it is critical to discover every piece of information of the obligations. Even if it feels intimidating, push you to ultimately face the money you owe directly. Make a listing of any costs, as well as amounts and you may rates. This may leave you an authentic picture of where something stand.

When you write-down your debt, take the appropriate steps to invest it well. Discover more about the fresh snowball and avalanche ways to figure out which debt reduction approach work effectively for you.

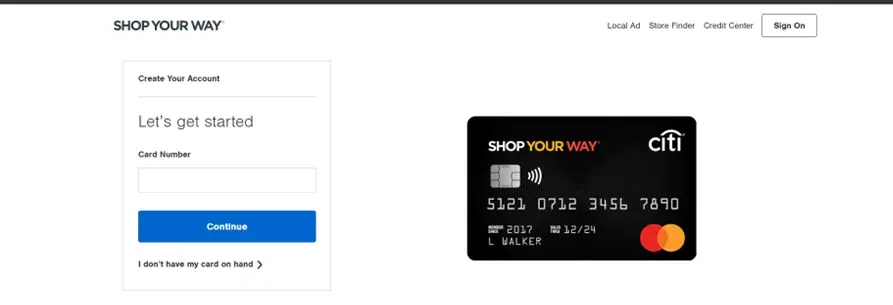

As the you are looking for an approach to lower debt, thought moving higher-notice bank card and loan stability to a different cards with a reduced rate. Balance transfers are really easy to done, too. Very financial institutions offer equilibrium transfer checks or allows you to import your balance through a simple process on the web.

Transfers of balance are going to be a perfect solution when you find yourself incapable of pay your funds or personal credit card debt, or if perhaps highest rates is remaining you from and come up with far out-of a drop in your overall equilibrium

As you believe an equilibrium transfer, watch for costs that eat out at the savings. As well as, pay close attention to what the interest rate might be toward the debt just after any unique basic offers discover.

If you very own your property, you are in a position to refinance your own home loan to minimize the https://clickcashadvance.com/installment-loans-ok/miami/ interest rate, slashed payments, or utilize family security. If you aren’t sure in the refinancing, here are some our guide to home refinance choices and also have let deciding if you should re-finance their home loan.

You’ll want to make certain that you may be working with a loan provider which could offer a lesser rates. Before you can re-finance, you’ll want to think about the pursuing the factors, among other things: one early incentives fees out of your latest bank; your current monthly payment and exactly what it would be which have an excellent brand new financing; therefore the updates of the borrowing from the bank, that’ll effect what you can do to get recognized getting a separate financing. For people who continue to have inquiries, speak to your prospective financial directly to get let determining whether or not it is a good move to you.

Regardless if you are think a summertime travel otherwise wishing to stop supposed on financial obligation within the next holiday season, you ought to establish another family savings for those motives. Setting aside small amounts of currency at once can help you avoid charging you such costs later on.

Whether you are seeking to refinance that loan or arranged a special deals express, call us right now to discover more about just how the products and attributes helps you be more economically complement. And if you’re trying brush through to your financial knowledge, go to our very own WalletWorks page to own stuff, films, and recommendations on anything from building your credit in order to securing oneself out-of con.

*PSECU isnt a credit rating department. Members need PSECU checking otherwise a great PSECU financing to be eligible for this particular service. Shared customers are not eligible.

The message considering within guide is for informational intentions just. Nothing stated is usually to be construed because economic or legal advice. Certain circumstances not offered by PSECU. PSECU doesn’t recommend people third parties, plus, although not restricted to, referenced some body, enterprises, teams, affairs, content, otherwise other sites. PSECU will not warrant people advice available with third parties. PSECU doesn’t ensure the precision or completeness of recommendations provided with businesses. PSECU suggests which you check with a professional financial, tax, legal, or any other elite group when you have inquiries.

Display this:

- Click to current email address a relationship to a pal (Opens up during the the new windows)